Newsletters

Do you know which business type is right for you? States generally allow businesses to operate as sole proprietorships, partnerships, corporations, and limited liability companies (LLC), and some have variations on these basic business types such as professional corporations and limited liability partnerships. Each business type serves a specific purpose, situation, or concern relating to…

Read MoreBy Katrina Brown Hunt It’s not just paranoia: Driving at night is actually more dangerous. According to the National Highway Traffic Safety Administration, fatal accidents are three times more likely at night compared with the daytime–but here are 12 tips that could help reduce your risk. The main reason that NHTSA finds driving at night is…

Read MoreThe Covid-19 stimulus bill or American Rescue Plan (ARP), signed into law in March 2021, contained a very important Affordable Care Act (ACA) expansion, relevant to AIA members. The ARP bill removes the income cap for federal premium subsidies for 2021 and 2022. This means that everyone is now eligible for a federal premium subsidy…

Read MoreWhile most people like to think the odds of becoming disabled are pretty slim, the U.S. Social Security Administration (S.S.A. fact sheet here) found that a 20-year-old worker has a one-in-four chance of becoming disabled before he or she reaches retirement age. Given this statistic—and the potential impact a long-term disability could have—working adults need…

Read MoreAll architects share the need for proper financial and retirement saving planning. For women architects, creating a sound financial and retirement plan is even more essential since issues like increased life expectancy, unforeseen changes in family structure, caring for aging parents, and the likelihood of outliving your spouse all present significant challenges for many female…

Read MoreSmall firms and sole proprietors with many questions but limited resources often wish for a convenient and cost-effective way to get the risk management assistance that they need to make important decisions. LegaLine is an AIA Trust member benefit service, formerly known as Practice Coach, that offers members access to qualified professionals who can help…

Read MoreTwo AIA Trust reports about digital practice risks have recently been updated. The 2021 Guide to Cyber Liability Coverage by independent insurance expert, Insurance Buyers’ Council, Inc., will help you understand what you need to know about cyber liability coverage for your firm. The 2021 update of BIM Me Up, Scotty–Navigating Risk in Digital Practice,…

Read MoreAs an architect, you know that starting with a comprehensive plan and building a good foundation is essential for success. You would never begin a project without a blueprint and process in place–but that’s exactly what many architects do when it comes to retirement planning. Many architects don’t know where to begin their retirement planning.…

Read MoreThere are few experiences in life that are as traumatic as losing a spouse. When life is upended through a divorce or the passing of your partner, it can be highly emotional—and it also presents serious financial challenges. Seeking financial help for single parents is a first step in this new phase of life. As…

Read MoreYou want to retire comfortably when the time comes. You also want to help your child go to college. How do you juggle the two? Saving for your retirement and your child’s education at the same time can be a challenge–but you may be able to reach both goals if you make some smart choices…

Read MoreThe AIA Trust has just formed a unique partnership with Pendella: a 50-state virtual insurance agency designed to support business owners and their employees with all their individual and employee benefits needs–including health insurance. With over 50 years of combined experience in insurance, human resources, and benefits administration technology, the Pendella team, complete with licensed…

Read MoreBy Ed Hord, FAIA, 2014 Chair, AIA Trust & Ann Casso, Hon. AIA, Executive Director, AIA Trust The slowly improving economy has led to an increasing pace of mergers and acquisitions among architecture firms. In addition, ‘baby boomer’ firm owners now considering retirement also fuel various ownership transitions. Privately owned architecture firms in today’s consolidating,…

Read MoreFor more than 60 years, the Victor and CNA professional liability program has maintained a solid and stable base policy while introducing innovative expansions of coverage. Just as the design and construction industry has evolved, so has their policy. The CNA policy has now expanded the definition of the term insured in a significant way…

Read MoreSetting up and participating in a retirement plan are important parts of an architect’s financial future. When you have a retirement plan, it is important to name a beneficiary. Understanding the options involved in setting a retirement plan beneficiary is an important part of your decision-making. Selecting beneficiaries for retirement benefits is different from choosing…

Read MoreWe are pleased to announce that GEICO is now part of the special AIA member benefit offerings offered to you by the AIA Trust for members and component staff of the American Institute of Architects. With a track record of more than 75 years, GEICO now extends its low rates along with a special membership…

Read MoreOne major effect of the COVID-19 pandemic is its effect on the economy and the cash flow issues it is creating for small business owners of all types–including architectural firms. Should you consider borrowing from your 401(k) now? As an architect, if you have a 401(k) plan at work and need some cash, you might…

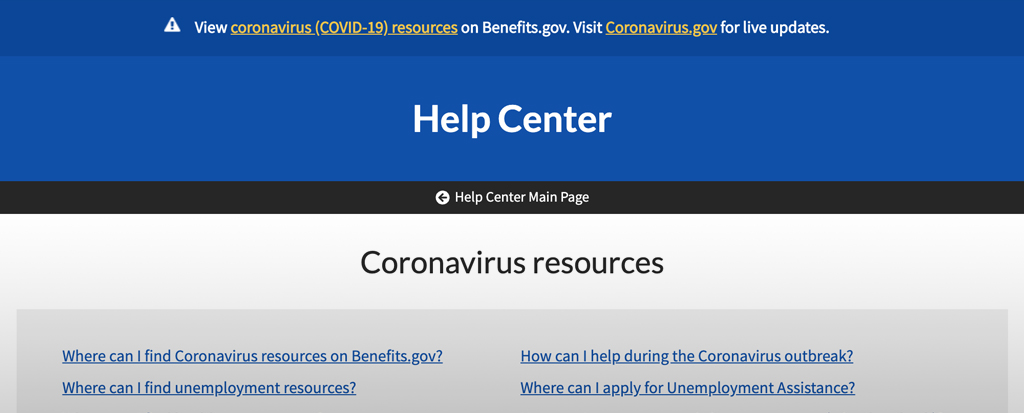

Read MoreThe new Coronavirus Aid, Relief, and Economic Security Act (CARES Act) that was just made into law may provide economic assistance for architects who are self-employed. Under Title II, Assistance for American Workers, Families, and Businesses the Unemployment Insurance Provisions Eligibility, the new law expands the scope of individuals who are eligible for unemployment benefits…

Read MoreMany architectural firms are tempted into believing they’re safe from cyberattacks because they don’t consider their data to be “sensitive” enough to attract criminals. A new article published by the AIA Trust is filled with real case studies and highlights how very attractive architectural firms are to cybercriminals, the most successful attack vectors currently in…

Read MoreOne of the most harrowing experiences I’ve ever had was during the sixth month of my pregnancy. My husband was out late, hadn’t called, and I was, of course, angry at his thoughtlessness. But this very evening, he had misjudged a bend in a rural, mountain road—and plummeted off the side of it into a…

Read MoreMost architects prefer to design the built environment rather than learn about legal concepts such as indemnification. While you should always engage your attorney to review contract language, this legal concept can significantly increase your risks on a project, especially if poorly written. An indemnification clause is your promise to cover the losses of the…

Read More