Newsletters

Architecture firms should take the time to establish meaningful fee collection practices so that they can remain financially solvent. Avoiding fee disputes with clients helps maintain positive working relationships while safeguarding the ability to provide services on future projects, including those of existing clients. Timely collection of fees is essential since architecture firms do not…

Read MoreYou might be surprised how The AIA Trust life insurance coverage from New York Life Insurance Company can provide for you and your family.

Read MoreFor architects, establishing a retirement plan for yourself and possibly for your firm, as well, is one of the most important actions you can take. If you have already done so, you are on the road to building a more secure retirement for yourself and your employees.

Read MoreWelcome to the “new normal” – a seemingly alternate universe where working in an office has become burdensome and employers and employees alike are often at odds as to what a work-life balance looks like. As if the practice of architecture wasn’t complicated enough, our post-pandemic reality challenges firms to adjust to a remote workforce…

Read MorePassionate in his pursuit of continuous engagement and advocacy for design and the profession, Jeff Yrazabal, AIA is leading the AIA Trust into 2024 as Chair. AIA has proven to be a steadfast way to harness this passion with other roles through the years which include past Co-Chair of AIA Portland COTE, President of AIA…

Read MoreConventional wisdom dictates that all successful construction projects have a great team. The project team is typically viewed as being the Client, Architect, and Contractor. However, other seldom discussed yet equally vital members of the team, are the Owner’s financial partners, which includes Lenders and Investors, along with their Construction Consultants.

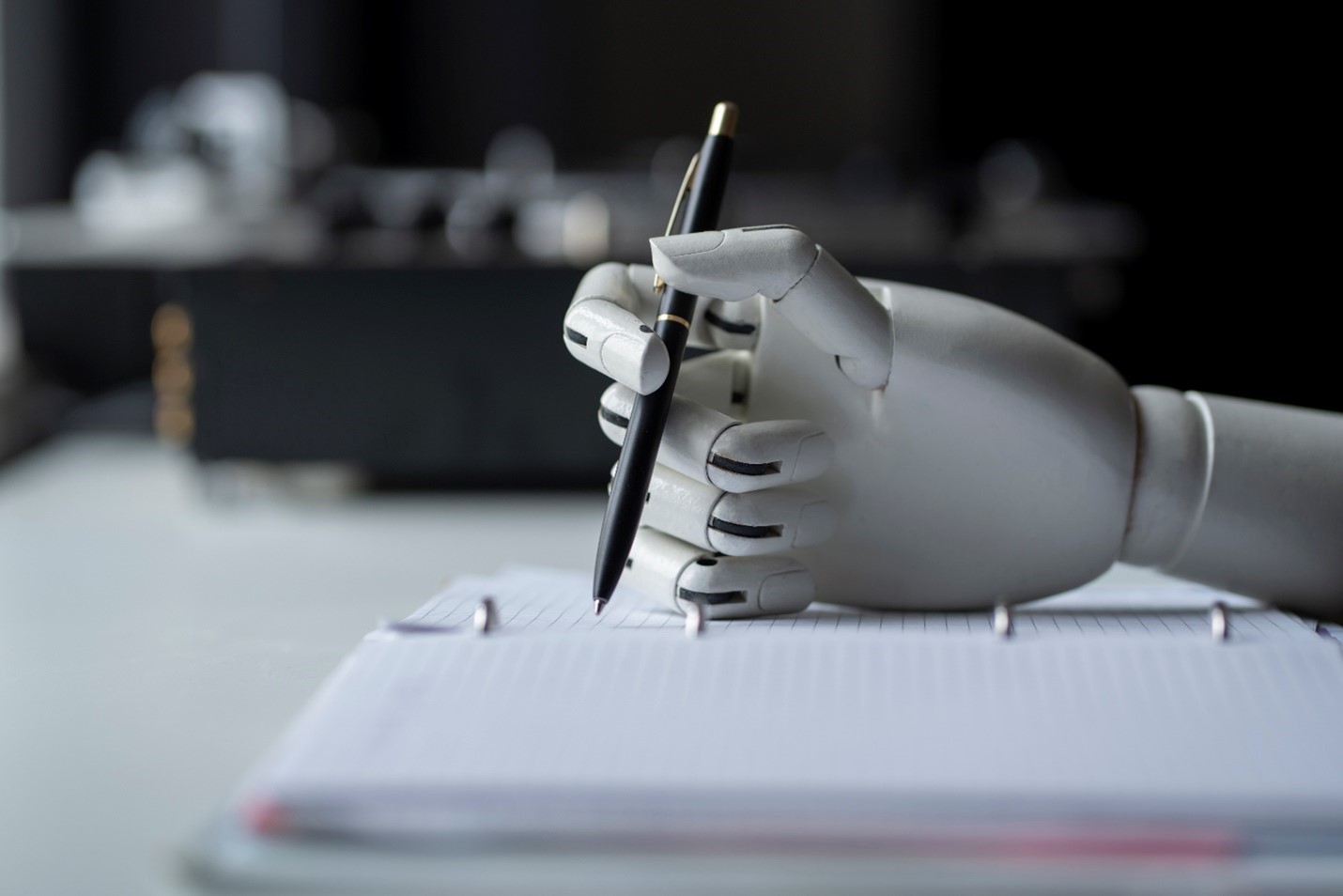

Read MoreIn 2005, my grandmother passed away at the age of 99. Looking at how artificial intelligence (AI) impacts society, I cannot help but reflect on the significant changes I have seen in a lifetime compared to what my grandmother must have lived through.

Read MoreBy: Steven Greenapple, SES ESOP Strategies, a Stevens & Lee Company When contemplating a sale of their business, the owners of a Company have several alternatives to consider. They can (1) sell to a financial investor (private equity or family office); (2) sell to a strategic investor (another business who wants to expand into the…

Read MoreDuring AIA Trust Week, one of the webinars shone a spotlight on LegaLine, a legal information hotline specially tailored to respond to the needs of small firms and sole proprietors managing an architectural practice.

Read MoreYou want to retire comfortably when the time comes. You also want to help your child go to college. So how do you juggle the two? The truth is, saving for your retirement and your child’s education at the same time can be a challenge. But take heart–you may be able to reach both goals…

Read MoreFor small-business owners, the importance of employee benefits is a significant factor when it comes to attracting and retaining talent. The majority of workers prefer attractive types of employee benefits—like insurance, paid time off, and a retirement plan—more than pay raises. Whether you’re competing for talent or keeping the high performers you already have, small-business…

Read MoreIf you believe that ESG and sustainable design are synonymous, you’re not alone. Diving deeper into their intricate nuances, we discover that ESG and sustainable design, while intertwined in essence, stem from different branches of our modern vocabulary. The confusion is indeed a matter of nomenclature and context.

Read MoreIntroduction In recent years, the design industry has experienced a significant disparity in experience levels among the workforce in the field of construction contract administration (CCA) services. With a visible gap between junior staff (1-5 years of experience) and senior staff (10+ years of experience), many firms are finding themselves in a conundrum, compelling less-experienced…

Read MoreAs an architect, you know that starting with a comprehensive plan and building a good foundation is essential for success. You would never begin a project without a blueprint and process in place – but that’s exactly what many architects do when it comes to retirement planning. Many architects don’t know where to begin their…

Read MoreHow confident are you about your knowledge of life insurance? According to LIMRA’s Life Insurance Barometer Study, fewer than 1 in 3 consumers believe themselves to be very or extremely knowledgeable regarding Life Insurance.

Read MoreThe Fable A sheepdog getting to the end of her prime working years, was told by the farmer that her final task was to select an appropriate replacement. So, early the next morning, she began her search of the farm for a suitable heir to her position.

Read MoreArtificial intelligence is transforming industries and streamlining processes at a dizzying pace. There’s a lot we don’t understand about AI, including the risks and exposures inherent in incorporating AI into our businesses and lives.

Read MoreOnce again standards were exceptionally high across the many excellent proposals received for the 2023 AIA Trust Component Grants Program. Over the last 17 years, Victor Insurance Managers, the partner-provider of the AIA Trust Professional Liability, Business Owners, and Cyber Liability Insurance Programs, have funded over $350,000 in grant awards made directly to components through…

Read MoreThe AIA Trust is always working for you to ensure that all the benefits we offer you and your firms as AIA members are the best they can be. We have some updates for you:

Read MoreThe Victor and CNA professional liability insurance program does not recommend specific language on “moonlighting.” That is because the situations vary so greatly. The key is for an architecture service firm to have a workable provision in an employee handbook. There are very few instances where an employer is held liable for the actions of…

Read More